Newsletter - February 2009

|

|

||

|

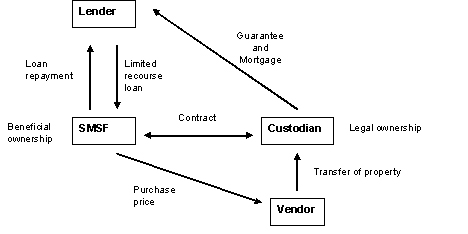

We have great pleasure in announcing details of the third seminar in our 'Business Development Series'. Greg Vale, an accredited specialist in Business and Personal Tax and the Principal of Vale Legal Pty Limited will be presenting a paper entitled 'Recent Developments for Self-managed Superannuation Funds'. Greg is the author of all the documents we provide to our clients in respect of establishing and maintaining SMSFs and is a sought after speaker in this specialised area by the Law Society of New South Wales and many other associations. Greg has provided some valuable information on SMSF borrowing through instalment warrant arrangements for publication in this edition of our Newsletter. Be sure to register early to reserve your seat at Greg's informal but informative presentation. Scroll down for these booking details. SMSF Borrowing - Instalment Warrant Arrangement A SMSF can now borrow money to purchase investments under an instalment warrant arrangement on the satisfaction of certain conditions. The arrangement can be diagrammatically represented as follows:

Type of property The SMSF may acquire any property under an instalment warrant loan which the superannuation fund could acquire directly. The Custodian The property must be held on trust by a Custodian. The Custodian is sometimes referred to as the "trustee" or "property trustee". The Custodian can be any person or entity provided it is not identical to the trustee of the superannuation fund. It is recommended that the Custodian be a special purpose company that has been newly incorporated for the purpose of being a "Custodian" in the instalment warrant arrangement. Trustee of the SMSF In the instalment warrant arrangement, the trustee of the SMSF will be the beneficial owner of the property as set out in the Custodian Deed. As the borrower, the trustee of the Fund is also responsible for the interests and loan repayments. The SMSF must ensure that it can fund these costs. Lender Most lenders are only providing loan agreements with the SMSF and security documents with the Custodian. The lenders are not providing the Custodian Deed. Vale Legal Pty Limited has a Custodian Deed that has been approved by Gadens Lawyers which acts for several lenders. For the borrowing to comply with the superannuation law it is fundamental that the liability on default of the borrowing by the trustee of the Fund is restricted to the rights relating to the property acquired with the money and not the other assets of the SMSF. Greg Vale's presentation will cover in detail: Should you wish to attend Greg's presentation please contact Robert on 9261 2100 or email robert@corporateexpress.com.au to reserve your place. The presentation will be held on Monday 23 March 2009 between 3.30 pm and 5.00 pm at the offices of Chartered Secretaries Australia, seminar room 2, level 10, 5 Hunter Street, Sydney. Office of State Revenue Ruling No. DUT 36 'Aggregation of Dutiable Transactions' This ruling clarifies the circumstances in which an aggregated assessment of dutiable transactions will be made by the OSR. It provides examples of transactions that would constitute 'one arrangement' and as such is of assistance to all those advising clients in this area. To access the ruling click here Risks of Money Laundering and Financing of Terror in the Professional Sectors Judi White, President of the Committee of Business Incorporators Australia Inc recently participated in a roundtable discussion on risks of money laundering and financing of terror in the professional sectors hosted by the Australian Institute of Criminology. In attendance were representatives of the: Of note was the concern of all participants of the practical implications of the proposed regulations in light of the very broad definition of activities that result in money laundering. It was also clear that the Government has very little information as to what is, in fact, the level of money laundering and counter-terror financing risks presented to those in the professional sectors in the day to day running of their respective practices. It is hoped by all those in attendance that the Government will place some credence in the fact that most professions caught by the proposed second tranche of the AML/CTF Act are already strictly regulated by both ASIC and their professional membership bodies. Should you wish to discuss the proposed changes to the AML/CTF Act or the other objectives of CBIA Inc please contact Judi on 1300 886 939 or via email jwhite@cbia.org.au Pension Drawdown Relief for Retirees Earlier this month Treasurer Wayne Swan and Senator Nick Sherry announced changes to the minimum draw-down requirement for account-based pensions. The changes will result in a 50% reduction in the minimum payment amount for the 2009 financial year. Click here to read the Media Release. The Corporate Express Business Development Series - Upcoming events We are pleased to confirm that Deanna Lane of Fastlane Consulting will present our next workshop on 'Tips for marketing in a new economic era'. Watch out for the date of Deanna's presentation in our upcoming Newsletter and her article entitled 'The recession two-stepEhis is how it works - and why it fails'.

DisclaimerThe information provided in this document is for your general information only. It is not intended that anyone adopt this information to their personal circumstances without first seeking professional advice. To view

or download this newsletter in pdf please click here |

|

||

|

|

|

|||||||

Why use Corporate Express?Our experienced and dedicated team can give your business the edge by providing:

|

|

|||||||

|

|

|

Company Registration | Register A Company | Shelf Companies | Company Formation | Register Company Name | SEO By E-Web Terms & Conditions |

Legal Disclaimer

| Privacy Policy

| Designed & Built by Tonic |

© 2012 Corporate Express |